This content is copyright to www.artemis.bm and should not appear anywhere else, or an infringement has occurred.

Australian primary insurance giant Suncorp Group has purchased a smaller reinsurance tower at the mid-year 2025 renewals and despite having spent time assessing alternative reinsurance structures, at this stage there appears to have been minimal change to its protection buying strategy.

A year ago, Suncorp renewed its main catastrophe reinsurance tower to provide protection up to $6.75 billion, having lifted the top by $350 million at the mid-year 2024 renewal.

A year ago, Suncorp renewed its main catastrophe reinsurance tower to provide protection up to $6.75 billion, having lifted the top by $350 million at the mid-year 2024 renewal.

For the 2025 to 2026 year, Suncorp has reduced the size of its reinsurance tower and also non-renewed a drop-down arrangements, as it seemingly seeks to reduce its costs of protection, even while acknowledging improved reinsurance market conditions, from a buyer perspective.

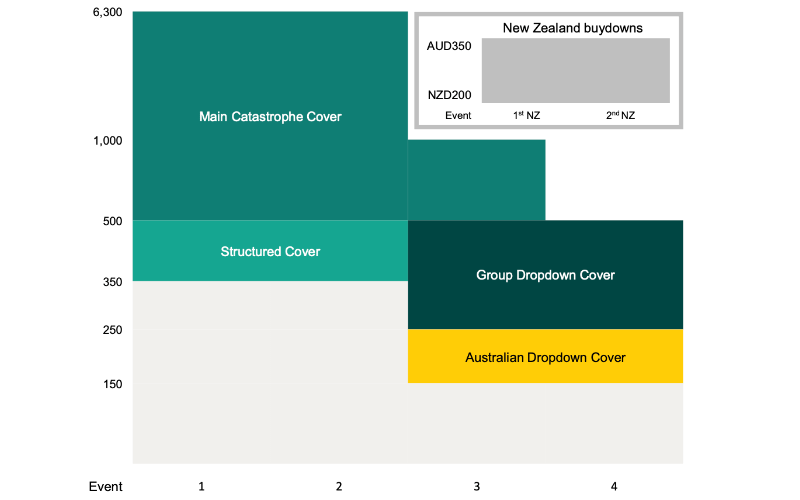

The renewed reinsurance tower features catastrophe limit up to a smaller $6.3 billion for the coming year, with catastrophe reinsurance available for major events from the same $350 million retention, for first and second events.

There are subtle changes to the overall reinsurance structure, that should enhance its responsiveness for the buyer, but in the main adjustments seem minimal.

Recall that, earlier this year, Suncorp said it was assessing “alternative” reinsurance structures for its next renewal at the mid-year, as the company looks to optimise its protection arrangements.

While there may be alternative capital embedded in the renewed program, on a collateralized or fronted basis, the insurer has not taken the step of venturing into the catastrophe bond market, or launching any kind of insurance-linked securities (ILS) structure of its own.

Suncorp said today that the review “explored a range of markets and both traditional and alternative reinsurance structures, including whole of account quota shares and aggregate cover programs,” with a goal to optimise for shareholder value.

“The review concluded that our clear objectives of optimising outcomes for our shareholders and customers would be best met by the program announced today,” Suncorp CEO Steve Johnston.

“In the current market, capacity has increased significantly for main catastrophe covers and pricing has improved. For other types of cover, including aggregate covers, capacity remains limited and expensive.”

Johnston added that Suncorp will “continue to monitor both traditional and alternative reinsurance markets and assess

future opportunities in reference to the considerations outlined above.”

Johnston also commented on reinsurance costs, saying, “Over the past couple of years, reinsurers materially reset their appetite for deploying capital to cover smaller or mid-sized events in both Australia and New Zealand. This, and increased reinsurance pricing, has seen the cost of insurance, particularly home insurance, increase rapidly.

“While the pricing of household policies will continue to reflect underlying risks and broader economic inflation, it’s pleasing that this major input cost appears to have stabilised.”

The main Suncorp catastrophe cover will protect the company against losses from $500 million and $6.3 billion, with one full prepaid reinstatement.

A multi-year structured reinsurance solution has been brought in to replace the group cover that reduced the retention to the aforementioned $350 million. This new addition features a profit share mechanism and reinsurer losses are capped at $600 million over a three-year term.

Suncorp noted that this new multi-year solution comes with lower cost, as well as the potential profit share benefits.

In addition, a second reinstatement of the $500 million to $1 billion layer of the main catastrophe program has been added, while citing it as inefficient, Suncorp said a dropdown limiting losses from a second event to $250 million has not been renewed.

Group dropdown covers have been purchased to reduce the third and fourth event retention to $250 million as well, and an Australian dropdown program continues to reduce retention for a third and fourth event in Australia to $150 million, while in New Zealand, buydown cover (including a prepaid reinstatement) has been purchased to cover between NZ$200 million and the Group’s maximum event retention of $350 million, in line with last year.

Analysts are calling the Suncorp program minimally changed this morning, saying that the company appears to be trying to further reduce its protection costs, despite its growing exposure base.

The upshot of the slightly changed reinsurance program is an expectation of slightly lower costs again for Suncorp, “reflecting strong reinsurance rate reductions and changes to the program, partially offset by exposure growth in the portfolio,” the company explained.

After alternative structure review, Suncorp buys less reinsurance with minimal changes was published by: www.Artemis.bm

Our catastrophe bond deal directory

Sign up for our free weekly email newsletter here.